Overview:

No VAT statement, as small business according to §19 (1) UStG.

Advanced B1- C1

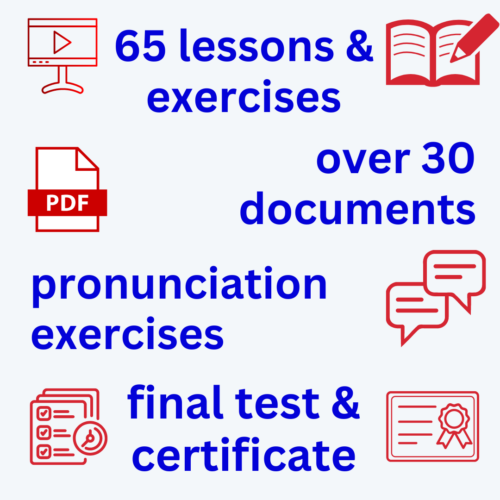

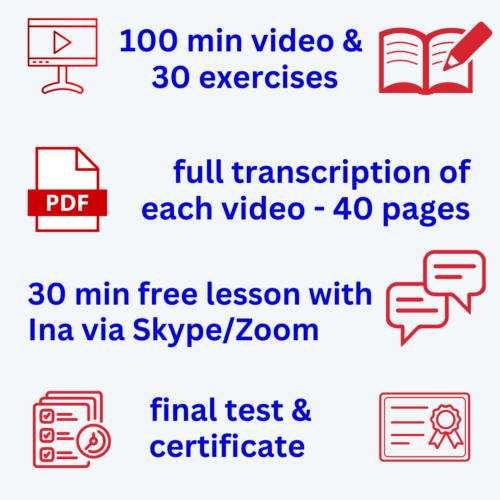

Course Includes:

No VAT statement, as small business according to §19 (1) UStG.

Advanced B1- C1

Overview:

No VAT statement, as small business according to §19 (1) UStG.

Advanced B1- C1

Materials of the course:

No VAT statement, as small business according to §19 (1) UStG.

Intermediate A2-B1

Materials of the course:

No VAT statement, as small business according to §19 (1) UStG.